Are Casino Winnings Taxed In Canada

No, since casino winnings are not considered taxable income in the vast majority of cases. Do professional gamblers have to pay for tax in Canada? Yes, as professional gamblers are considered to be running their own freelance businesses and using gambling as their main source of income. The Canada-US Tax Treaty In Canada, gambling winnings, be they from casino games or from playing the lottery, nings from casino games, such as slots, are to be measured. You must also include the Free Money Gambling Online names of the other people present while you were gambling and the amounts won and lost should be recorded.

- Are Online Gambling Winnings Taxable In Canada

- Are Gambling Winnings Taxed In Canada

- Are Casino Winnings Taxed In Canada Now

- Are Casino Winnings Taxed In Canada 2020

- Are Casino Winnings Taxed In Canada Today

Everyone dreams of winning the lottery or hitting the jackpot at the casino. But you may wonder how much tax you’ll pay on all that money. The good news is that in Canada, your winnings are usually tax-free!

Lotteries

Winnings from a Canadian lottery such as Lotto Max or 649 are considered to be windfalls, and windfalls are not subject to tax.

Even winnings from a sweepstake or lottery sponsored by a charitable organization are generally tax-free. Everything from your local hockey team’s 50/50 draw to the Big Brothers/Big Sisters travel lotto vouchers are included in the windfall category and therefore not subject to tax.

However, though the Canada Revenue Agency (CRA) does not tax the winnings themselves, you may need to pay taxes on any income that money generates if you invest in a non-registered investment or account.

For example:

- If you put your lottery prize in the bank, any interest earned on that account will be taxable.

- If you invest some of your winnings in stocks or mutual funds, any dividends earned on the investments will be taxable. As will any Capital Gains you may make when you dispose of or sell the investments.

For this reason, if you do plan on investing your winnings, you may want to consider investing in your Tax Free Savings Account (TFSA) or Registered Retirement Savings Plan (RRSP) if you have the available contribution room. This TurboTax article explains further Paying Taxes on Investments.

Casinos

If you score big from a Canadian casino, your winnings will be treated the same as other lotteries and usually remain tax-free.

However, over the past few years, the CRA has begun looking for professional gamblers, classifying their “winnings” as business income and therefore taxable like any other business income. At the same time, this also means professional gamblers can claim business expenses. In theory, pro gamblers should also be able to claim losses as a business loss, but the CRA usually doesn’t allow it.

Workplace Contests

Prizes won from your place of employment aren’t always tax-free.

Cash awards or near-cash awards such as gift cards, are almost always considered to be taxable employment benefits. This means the award will be considered as part of your income and should be reported on your T4- Statement of Remuneration Paid in Box 40. Your employer will deduct income tax, Canada Pension Plan (CCP) and in some cases, Employment Insurance (EI) premiums on this type of award or prize.

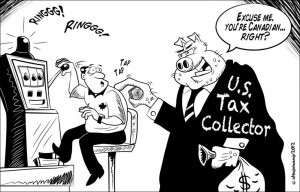

What Happens in Vegas Stays in Vegas…

The rules discussed above only apply to winnings from Canadian sources. If you like to gamble or play lotteries that are based in the US, their government has different rules that would apply even if you are not a US citizen.

The US Internal Revenue Service (IRS) considers all winnings to be taxable. If you win a US lottery, you would have to file a US tax return and pay taxes on the prize. If you hit the jackpot at a casino, a good chunk of those winnings will be withheld by the casino to ensure your tax obligations are met before you even leave the country.

Even if you are gambling online from your own home, if you play on a US online poker site, any winnings or prize money will be considered to be American income and taxed accordingly.

With more than 20 years’ experience helping Canadians file their taxes confidently and get all the money they deserve, TurboTax products, including TurboTax Free, are available at www.turbotax.ca.

Related Posts

Rules concerning income tax and gambling vary internationally.

United States[edit]

In the United States, gambling wins are taxable.

The Internal Revenue Code contains a specific provision regulating income-tax deductions of gambling losses. Under Section 165(d) of the Internal Revenue Code, losses from “wagering transactions” may be deducted to the extent of gains from gambling activities.[1] Essentially, in order to qualify for a deduction of losses from wagering, the taxpayer can only deduct up to the amount of gains he or she accrued from wagering. In Commissioner v. Groetzinger, the Supreme Court Justice Blackmun alludes to Section 165(d) which was a legislative attempt to close the door on suspected abuse of gambling loss deductions.[2]

Wagering Transaction[edit]

The Internal Revenue Service has ruled that a “wagering transaction” consists of three elements.[3] First, the transaction must involve a prize. Second, the element of chance must be present. Finally, the taxpayer must give some consideration.

Section 165(d) and Professional Gamblers[edit]

Are Online Gambling Winnings Taxable In Canada

In Bathalter v. Commissioner, a full-time horse-race gambler had gains of $91,000 and losses of $87,000.[4] The taxpayer deducted the expenses under Section 162.[5] The service argued that Section 165(d) precluded the taxpayer from engaging in gambling as a 'trade or business.'[4] The Tax Court held that the taxpayer's gambling was a business activity and allowed the deductions.[6] In essence, the court held that Section 165(d) only applies when a taxpayer is at a loss instead of a net gain and “serves to prevent the [taxpayer] from using that loss to offset other income.” [7] However, if the taxpayer has a net gain, as the horse-race gambler did, then the taxpayer may deduct the expenses under Section 162, and Section 165(d) does not apply.[8]

Section 165(d) and Recreational Gamblers[edit]

In addition, in Valenti v. Commissioner, the court reiterated that Section 165(d) applies to professional gamblers as well as recreational gamblers.[9] The court stated, '... it has been held both by this Court and various courts of appeals that wagering losses cannot be deducted, except to the extent of the taxpayer's gains from wagering activities, and it has been so held even where such activities were conducted as a trade or business as opposed to a hobby.'[10] Therefore, for example, if a recreational gambler visits a casino one Saturday and accumulates $600 of losses and $200 of gains, that recreational gambler may deduct $200 of the wagering losses (because she can only deduct an amount up to the amount of wagering gains she accrued).

Are Gambling Winnings Taxed In Canada

United Kingdom[edit]

In the United Kingdom, wins (unless in the course of a trade) are not taxable and losses are not deductible.

Germany[edit]

In Germany, wins are taxable since July 2012 by 5% of the winnings (profit).

Canada[edit]

In Canada gambling income is not generally taxable. If the gambling activity can be considered as a hobby, the income is not taxable.[11][12]

If the gambling is carried out in businesslike behaviour, then the income is taxable and losses deductible. Making approximately $50 million in sports lottery bets and earning a profit of $5 million was not considered businesslike behaviour in Leblanc v. The Queen. However, in the case of Luprypa v. The Queen the gambling income was ruled to be taxable. The case involved a skilled pool player that profited approximately $1000 per week playing staked pool games against bar patrons.[12]

Poker differs from many other forms of gambling as skilled players may increase their chances of winning significantly. In the case Cohen v. The Queen judge ruled that the gambling activities were not conducted in sufficiently businesslike manner and thus the losses were not deductible.[12]

See also[edit]

Are Casino Winnings Taxed In Canada Now

References[edit]

Are Casino Winnings Taxed In Canada 2020

- ^IRC Section 165(d).

- ^480 U.S. 23, 32 (1987).

- ^Technical Advice Memorandum 200417004.

- ^ abT.C. Memo 1987-530.

- ^IRC Section 162.

- ^Id.

- ^Id.

- ^Id.

- ^T.C. Memo 1994-483.

- ^Id.

- ^Bonusfinder Canada. 'Do I need to pay taxes on my casino winnings?'. www.bonus.ca. Retrieved 24 February 2020.

- ^ abcRotfleisch, David. 'Taxation Of Gambling And Poker Winnings – A Toronto Tax Lawyer Guide'. mondaq.com. Retrieved 24 February 2020.